and easy into the future

financial markets

|

Pecunio also specialises in providing expert consulting services to distinguished blockchain start-ups by providing each individual client with a taylor made business plan because we recognize diversity.We want to open the vibrant cryptocurrency market to everyone — demystifying blockchain investments and allowing everyone to participate in the new economy of the 21 century.

By tokenizing all our funds and assets, we simplify investments into selected ICOs, angel & venture capital funds and cryptocurrencies. All major cryptocurrencies will be interchangeable on the platform for free. Pecunio opens an exclusive investment universe to everyone.

A multi-asset prepaid debit card, enabling token spending in fiat currencies around the world. These prepaid debit card payments without local exchange fees make digital currency spending a whole lot easier. Pecunio enables cryptocurrency spending with instant liquidity.

Our expertise in traditional and hedgefund management qualifies us to accompany blockchain businesses successfully spreading their wings. We launch ICO campaigns with a dedicated fund, management support, legal advice and more. Pecunio shares the profits with its token holders.

WE PUT THE POWER BACK TO WHERE IT BELONGS — INTO THE HANDS OF THE PEOPLE.

Pecunio’s mission is to open the vibrant cryptocurrency market to everyone, encouraging blockchain adoption and democratizing ownership of cryptocurrencies. As the economic fruits of technological innovation are usually harvested by affluent investors with deep pockets and insider knowledge only, Pecunio now makes it possible to own, transfer and invest into cryptocurrencies like Bitcoin, Ethereum & others by the average individual, allowing participation in the new economy.

We personally believe in the philosophical mission established by Satoshi Nakamoto, the creator of the idea of the blockchain, creating a fund universe that is safe, easily accessible and affordable to the average person.

POTENTIAL OF THE PROJECT

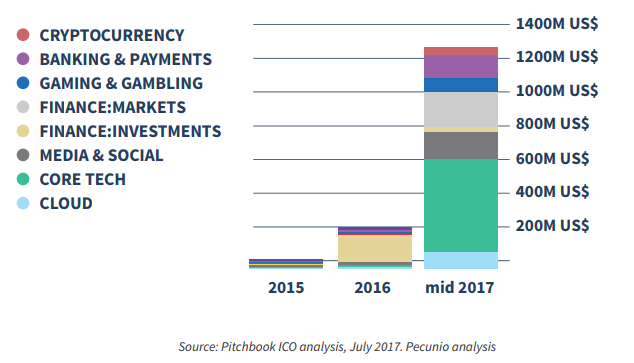

Within the last 30 months, the ICO market grew from a mere 14 million US $ to a whopping 2.6 billion US $. Finance & Investments is still heavily underrepresented as a category, due to a lack of innovation and decentralization. With its unique business proposition, Pecunio is expected to capture a significant market share in its ICO proceeds and beyond.

The dawn of a new investment era began starting with the incredibly successful Ethereum ICO in July 2014. Imagine having invested an amount of two thousand dollars in ETH at that time. Right now in 2017, in less than three years, those two thousand dollars would be worth over 1 million US $.

The same applies for blockchain solution “Stratis”: Only 12 month after its ICO, tokenholders have multiplied their initial investment by factor 600. ICOs can multiply your investment and are the most rewarding investments ever, when done well. It is our business venture to spot, target and support potential top performers in this hyper-dynamic market.

Investing into ICOs and tokenized AC & VC leverages the performance of our funds compared to regular cryptocurrency investments by far. Our fund management avails of profound experience from the traditional- , as well as from the hedge fund industry, managing funds with volume size of 250 million $ US and more.

Pecunio’s cryptocurrency card is a multi-asset prepaid debit card, enabling token spending in all fiat currencies around the world without exchange fees. The user will be able to manage assets via the platform, charging the card with Bitcoin, Ethereum, Litecoin, Monero, Dash, Ripple and many other cryptocurrencies more to come.

All of our tokens are ERC-20 standard and based on Ethereum; a global, secure decentralized verification network, that enables tokenizing our blockchain funds. Pecunio’s PCO tokens receive proceeds from three sources: The management-, the performance-, and the ICO fees. Pecunio will earn substantial amounts from commission in short time, making it a true blue chip investment for its token holders.

Our platform simplifies the access to the sometimes complicated handling of smart contracts for nontech-savvy users. Active customer support, together with an easy-to-use interface, contributes to our platforms value. Part of our customer-centric approach will be a free exchange for cryptocurrencies, making Pecunio a one-stop-shop for easy investments.

Another supporting pillar of Pecunio´s unique position in the market. Our user have customerlifetime-value since as we are not a product-centric seller or exchange, but a care taker with active management and active customer support.

WHY BLOCKCHAIN WHY FUND MANAGEMENT?

Why Blockchain?

+ Tyler Winklevoss, Co-creator of Facebook, top investor in Bitcoin

The Blockchain is a foundational technology like the Internet itself — a big system enabling applications to be built on it and value to be stored and transferred safely via a transparent public ledger. The idea of a decentralized, global payment network with low cost and settlement time has profound implications across the world-wide financial system.

Abstracting away from solely the financial sector, the transparency and integrity of data on the Blockchain may transform broad industries and industry standards in areas like record keeping, logistics, law, identity management, securities settlement, application development and many more. Furthermore corporate formation & governance, asset representation, contract & agreement structuring, and the traditional thought processes associated with; each are rapidly being challenged, questioned, re-thought, reapproached, and re-structured because of the spark ignited by the concept of the blockchain.

We now find ourselves at the forefront of a huge wave of innovation. Approximately 80% of banks are developing their own blockchain technology today. This is one of the main reasons the world’s biggest firms are now investing into this promising technology and/or adopting it as well.

The real value of the blockchain is that it renders intermediaries completely obsolete. Middlemen acting as third party establishing “trust” between unknown parties are no longer inevitable. The blockchain basically replaces these middlemen.

+ Financial Services

Banks are essentially secure storehouses and transfer hubs for money. Blockchain’s secure, decentralized, and tamper-proof ledger addresses this function — at a fraction of the cost. A company called “Thought Machine” has already created a “blockchain bank.” Clearing houses and stockbrokers are also in the firing line for the same reason. Companies like Western Union and MoneyGram have always dominated money transfer services. But blockchain start-ups are trying to create a competitive scenario by offering faster, cheaper and versatile forms of money transfer.

+ Real Estate

When most people think of buying and selling property, they think of copious amounts of paperwork, a long, drawn-out process, and high agent fees. Using blockchain, anyone can manage, track, and transfer land titles and property deeds — no need for intermediaries. A firm called Ubitquity is providing this service right now.

+ Music Streaming

Music streaming is great — well, maybe not for the musicians. It’s estimated that artists lose up to 86% of the proceeds of their music because of illegal downloading. The blockchain makes it possible for artists to earn royalties on their

music without going through a record label. Grammy Award Winner Imogen Heap has created a blockchain-based streaming platform called MYCELIA that is, besides others, facilitating this issue

Why Fund Management

Despite Bitcoin’s impressive annualized returns since its inception in 2009, the reality is that blockchain technology is still in its infancy and no one knows whether it will become globally accepted. This uncertainty surrounding blockchain and Bitcoin’s future is reflected in the price volatility of cryptocurrencies. When it comes to investing in cryptocurrencies and ICOs, there are a few risks investors need to be aware of and mitigate:

+ Regulatory Risk

Probably the biggest risk to the future success of Bitcoin, as both a currency and as an investment class, is regulatory risk. If China, for example, decides to ban its citizens from holding Bitcoin, the price of the digital currency would crash. China is by far the largest market for Bitcoin trading, with over 90 percent of trading occurring in the People’s Republic. Hence, any negative regulatory changes would have a direct impact on the world’s Bitcoin investments.

The same goes for leading Bitcoin start-up hubs like the U.S. and the U.K. Should any large economy ban Bitcoin, the price will collapse and struggle to recover.

+ ICO Scams

Many ICOs/token launches lack legitimacy for one of the following reasons:

+ Some ICOs are outright scams. Their founders simply cash in on the absurd amount of “dumb money” that people throw into token launches. (The “investors” can often be people who missed the boat on Bitcoin and/or Ether, who truly don’t understand the differences in between the various cryptocurrencies, particularly when it comes to value.)

+ Other ICOs are illegitimate because they are essentially a solution without a problem — not everything needs a decentralized application with its own currency. Because of these risks, a significant set of due diligence questionnaire has to be implied before buying into a potential ICO.

It is asked too much, for an average individual with a day job to occupy oneself with all the details of a rapidly changing market. In order to react to these dynamic systems it needs experts and due diligence; both are pillars of our performance policy, which is the reason why we preferred active management of our funds in order to adapt to fluctuated markets. Additionally portfolio diversification mitigates market volatility, fraud and operational risks while as being a hedge fund renders us profitable even during falling markets.

HOW PECUNIO WORKS

The user signs up to create an account on Pecunio’s platform by providing an email address, a user name and a password. Upon confirmation via email, a personal wallet is created and he is automatically directed to the user dashboard where he finds an overview of his personal account and holdings.

After successfully transferring cryptocurrencies or fiat money into his account, it is now the user’s choice whether to spend it via the crypto card or rather exchange or rather invest cryptocurrencies into Pecunio’s investment products.

Every investor has the opportunity to invest into different type of funds. For now there are three fund tokens available, besides the exchange-tradable Pecunio token.

Generated value is distributed to investors by the PCO utility token, which returns fees from tokenized ICOs, AC & VC and cryptocurrency funds. Additionally, value is guarded by regular burning of tokens

Another important function of the Pecunio Platform is the regular distribution of fund fees. 25% of the proceeds are reinvested to multiply the return to the investors via compound interest. 25% of the proceeds are paid to the investment advisor in form of a performance fee. 50% of the proceeds are distributed among the fund’s token holders via a buy-back process. In this way, distribution of income provides liquidity of the fund’s tokens. Bought-out tokens are burned so that income will continue to increase for the remaining fund tokens.

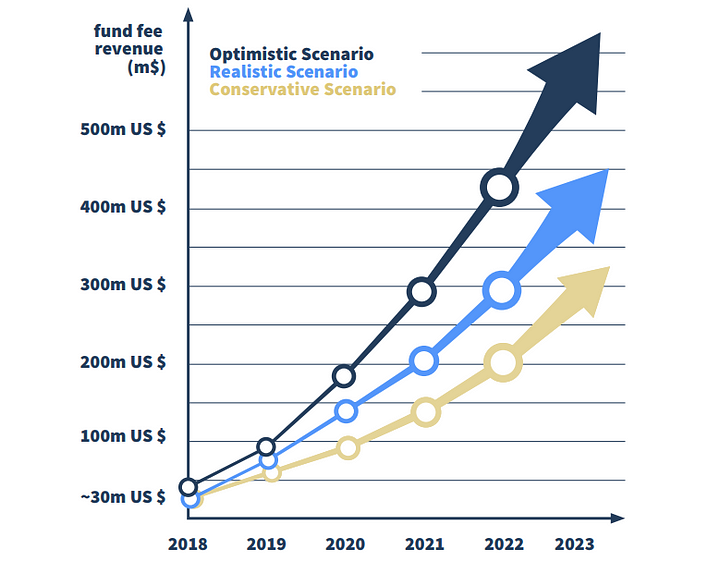

Pecunio‘s innovative business model is profound and elaborate, but has short operational history in the young cryptocurrency fund market. It is a delicate task to evaluate prospects and future financial results with absolute precision, which is why we offer three possible scenarious to help understand different levers and possible outcomes for our project:

TOKEN SALE PROCEDURE — PROJECT FUNDING

The asset tokens will be represented as smart contracts on the Ethereum blockchain. Coding and customizing work will be done in Solidity, a high level programming language similar to javascript, targeting the Ethereum Virtual Machine (EVM), which is the runtime environment for smart contracts in Ethereum.

The PCO asset contract collects 2–6% yearly management fees on all funds, as well as a performance fees (between 15% and 30%, depending on the fund offering). PCO token holders will be able to access their assets through a “redeem and burn” mechanism.

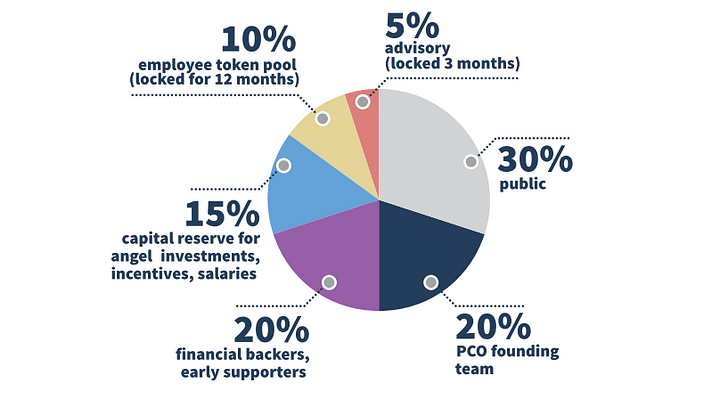

To fund the project, we conduct a token sale issuing 40 million Pecunio tokens (PCO) in total after the ICO campaign successfully ends. The total supply amount of tokens is 100 million PCO tokens.

Hardfacts

+ Our crowdsale is yet confidential but everyone who pre-registered will be personally invited to our closed-end tokensale. It will last 30 days.

+ PCO Tokens are Ethereum ERC-20 tokens

+ 30,000,000 will be sold in the token sale.

+ Exchange Rate: 1ETH (or equivalent ) = 200 PCO

+ The token sale will be hard-capped upon receipt of 150.000 ETH

+ BTC, ETH, XRP and LTC are accepted for the purchase of PCO Tokens

+ No more PCO will be created after this period in order to avoid inflation.

+ Token distribution starts with 1st of February 2018.

Token Value

PCO tokens represent ownership tied to the PCO asset contract (see below), namely the rights and obligations arising from the Pecunio universe of funds (especially management and performance fees), and ICO service fees. Tokens are a digital asset, bearing no intrinsic value by themselves, but the value based on their underlying assets, properties and/or rights. PCO tokens allow their holders to receive these fees on a pro rata basis.

+ 20.000.000 of PCO created during the creation event will be allocated to Pecunio founders

+ 20.000.000 PCO will be allocated to financial backers and early stage supporters

+ 10.000.000 of PCO created during the creation event will be allocated to the company and utilized as a future employee token pool, to strengthen our ability to attract & retail top talent; these tokens will be locked for 12 months

+ 5.000.000 of PCO created during the creation event will be created for and granted to advisors; these tokens will be locked for 3 months

+ 15.000.000 of PCO will be credited to the reserve, but not issued. These PCO´s will be available as an additional source of funding, but may never be issued, depending on circumstances in the future

Exchange

The exchange works via a matching engine through asset proxies. The interface is therefore linked to external exchanges and addresses via the asset proxy smart contract, which complies with ERC-20 standards.

+ Manipulation-safe

+ Written in a hardware-friendly programming language to maintain speed

+ Closed environment — with consideration of future decentralization

Wallets

Written in Javascript, among ohters Bitcore framework.

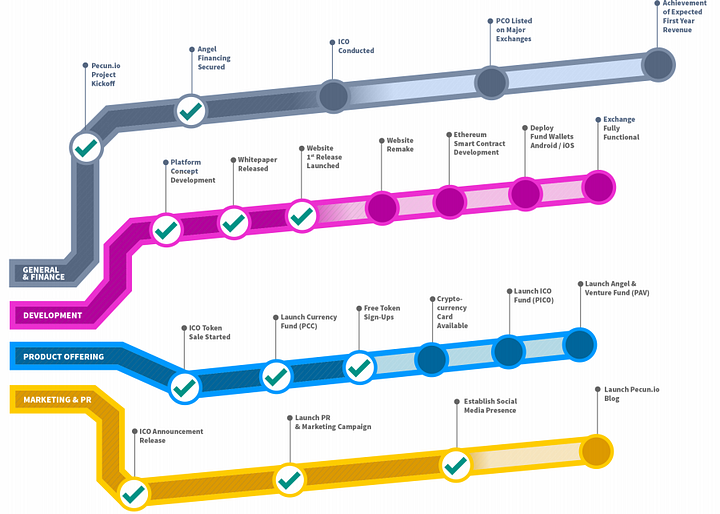

ROADMAP

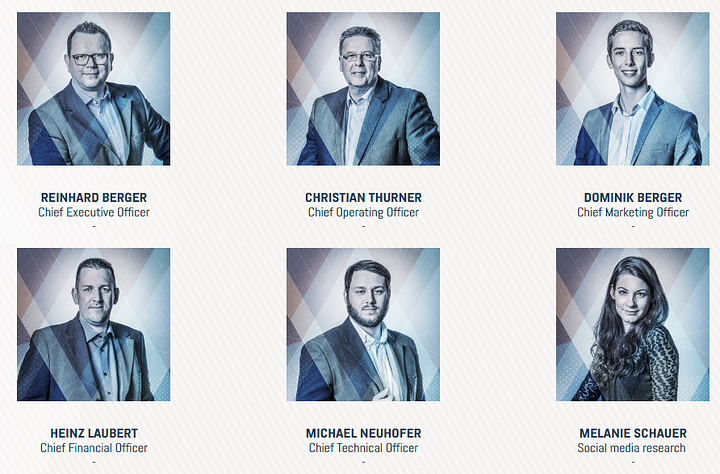

TEAM AND VALUES

You can share your thoughts on our Telegram channel, or contact us by e-mail, or social media.

WEBSITE: https://www.pecun.io

WHITEPAGER: https://pecun.io/Pecunio_White_Paper.pdf

FACEBOOK: https://www.facebook.com/PecunioFund/

MEDIUM: https://medium.com/@Pecunio

STEEMIT: https://steemit.com/@pecunio

TWITTER: https://twitter.com/Pecun_io/

TELEGRAM: https://t.me/pecunio

E-MAIL: office@pecun.io

Username profile BTT : Gis15

My ETH :0xAd2E59d183E4D68249851851F275309181658c28

My ETH :0xAd2E59d183E4D68249851851F275309181658c28

.png)

Tidak ada komentar:

Posting Komentar